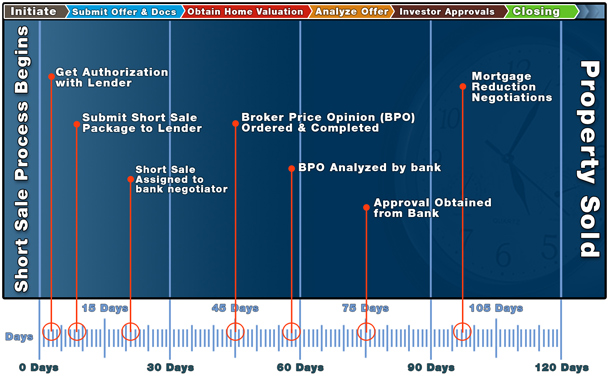

Wildomar Short Sale Timeline

Short Sale Timeline

The Wildomar Short Sale Timeline diagram is a general illustration of the stages involved in completing a short sale and the estimated number of days each stage may takes. Short sale timelines differ between banks, and are affected by the number of liens and the balances due, and may not follow the process illustrated on the diagram. While few banks will ever process their short sales in the same amount of time as other banks, most will still adhere to the same stages illustrated in the diagram with few exceptions or differences.

Short Sales: Step-by-Step

The majority of the tasks performed throughout the short sale process will be completed by the seller’s listing agent or assistant. It is customary for the bank to deal with a qualified real estate agent in a short sale. The diagram above illustrates the short sale timeline. This section of the page will highlight what happens at each stage of the process and what might be expected of the homeowner:

1. Listing agent sends the lender a 3rd-Party Authorization Form, granting the agent and/or designated assistant access to receive information from the bank on the seller’s behalf.

2. Offer is received and approved from a pre-qualified buyer and the homeowner prepares a list of documents for the agent or assistant to submit to the bank for review. This will include income tax returns, bank statements, paycheck stubs, and other financial disclosures.

3. Offer, pre-qualification letter, and HUD-1 are sent to the bank by the listing agent or assistant along with the homeowner’s financial documents. This is called a “short sale package” and may also be referred to at the bank as the short sale “file.”

4. File is assigned to bank negotiator.

5. Bank sends an independent licensed real estate broker to the property to perform a valuation called a “Broker’s Price Opinion (BPO).” The BPO is meant to give the bank a general snapshot of the property value and condition.

6. BPO agent sends the valuation to the bank.

7. Short sale package and BPO are reviewed by the bank and their investor.

8. Bank and/or Investor decide to either approve or reject the homeowner and the listing agent or assistant request for a short sale.

9. In the case of an approval, a written acceptance is sent to the homeowner for review and the buyer initiates their mortgage-loan approval process.

10. Buyer performs inspections and closes escrow on the property.

Leave A Comment